Transfer pricing still leaving ugly legacy

Transfer pricing is continuing to screw-down foreign-invested enterprises’ modest tax contributions to Vietnam’s state budget.

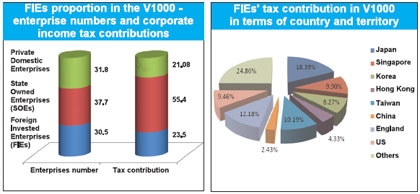

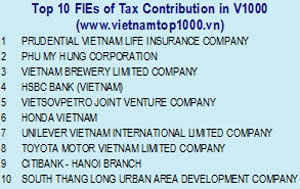

In the list of Top 1000 Enterprises of Tax Contributions in Vietnam (V1000), foreign-invested enterprises (FIEs), which account for 30.5 per cent of the V1000, contributed VND20 trillion ($1.05 billion) in corporate income tax, or 23.5 per cent of V1000’s tax payment, from 2007 to 2009.

“The contribution is quite a modest number compared with the large proportion of FIEs in economic activities in Vietnam,†said Le Anh Duc, director of research at Vietnam Report Joint Stock Company, a local enterprise ranking and research firm which published the list.

Duc said in 2009, FIEs contributed 17.5 per cent of gross domestic product (GDP), 43.4 per cent of industrial production value and accounted for 52.7 per cent of Vietnam’s total exports.

In a recent forum, Association of Foreign Invested Enterprises chairman Professor Nguyen Mai said around $60 billion in foreign direct investment had been disbursed. However, FIEs’ contribution to the state budget each year was only about $1.5 billion.

“The management of business activity and revenue of multinational companies is still a big problem in Vietnam. It is likely that some FIEs’ profits have been transferred to parent companies via transfer pricing,†Duc told VIR.

Commenting on the survey, former director of the Central Institute for Economic Management (CIEM) Le Dang Doanh said: “It is unreasonable that FIEs made such low tax contributions despite their usage of Vietnam’s natural resources and energy, especially electricity.â€

Doanh said a handful of foreign-backed enterprises had reported fake losses for several consecutive years to avoid paying tax, while expanding their businesses and production.

According to the Ho Chi Minh City Taxation Department, 60 per cent of FIEs in the city reported losses in 2009 and 50 per cent in 2008. Meanwhile, Lam Dong’s statistics showed that up to 104 out of the 111 FIEs in this province reported losses.

“How can they continue their business activities with such big and long-lasting losses,†Doanh said.

He said by raising the prices of materials purchased from parent companies abroad, while selling the products to parent companies at low prices, many enterprises always stayed in the red which helped them to evade corporate income tax. “This situation originated from legal loopholes. However, it is not easy to get sufficient data to prove FIEs’ transfer pricing,†Doanh told VIR.

Within the V1000, the tax contributions of state-owned enterprises (SOEs) was 55.4 per cent, nearly 2.4 higher than FIEs, while the number of SOEs in the V1000 accounted for 37.7 per cent, against FIEs’ 30.5 per cent.

Meanwhile, Duc said another reason for FIEs’ low tax contributions compared to SOEs was the Vietnamese economy’s structure. “In the local economy, information & communications, banking and mining are the most lucrative sectors. Meanwhile, those sectors have seen dominant involvement of the state. VNPT, Viettel, Vietcombank and PetroVietnam are cases in point.â€

“Foreign-invested banks with the biggest tax payments contributed only $163 million, while this number for local banks was nearly $344 million. In the information an communications sector, SoEs’ tax contributions reached $ 591 million, four times greater than FIEs,†Duc added.